Fleet Insurance Bleeding Your Margins? Here’s How to Fight Back with Proactive Risk Management

For fleet operators, insurance is a volatile, growing burden that can make or break margins.

Rising premiums. Unpredictable renewals. Surprise exclusions. Even if you haven’t had a recent incident, the average trucking fleet saw insurance costs spike over 40% in the last decade. The pressure is particularly acute for mid-size and large fleets running in high-risk corridors or operating overnight and fatigue-prone schedules.

So how do you control insurance spend without compromising operations?

It starts by understanding what insurers are really pricing into your premiums (and how you can actively reduce those risk signals before your next renewal).

What’s Driving Fleet Insurance Costs?

Insurers set your premiums based on both historical data and perceived future risk. If you’re only focusing on compliance or lagging indicators like past crashes, you’re missing the full picture of what drives rates.

Here are five major cost factors that influence fleet insurance:

1. Crash History and Frequency

This is the most obvious one. Fleets with even a handful of preventable collisions (especially rear-end or rollover crashes) often see immediate spikes in premiums. Claims involving third parties, injuries, or fatalities result in the steepest cost increases and higher deductibles.

2. Nuclear Verdict Risk

Lawsuits from trucking incidents are growing in frequency and severity. So-called nuclear verdicts in trucking — jury awards over $10 million — are increasingly common. Insurers are pricing this litigation risk into your base rates, especially if your safety documentation is inconsistent or incomplete.

3. Lack of Proactive Risk Controls

Insurers are no longer satisfied with fleets that are simply compliant with Hours of Service or that use dashcams. They want to see proactive programs that prevent incidents before they occur: predictive safety tech, documented countermeasures, and clear decision-making workflows tied to leading indicators like fatigue, distraction, and speed.

4. Fatigue Risk Exposure

Fatigue is one of the most under-recognized drivers of preventable incidents, and it's a red flag for insurers. According to the NTSB, fatigue is a factor in up to 40% of heavy truck crashes, and those crashes average $91,000 per event in direct costs. But beyond the crash itself, fatigue often leads to harsh braking, missed deadlines, cargo damage, and driver churn, all of which compound your risk profile.

5. Operational Transparency

When underwriters assess your fleet, they look for clear, consistent visibility into your safety operations.

- Can you show how you're assessing daily risk?

- How supervisors make decisions?

- How you document fatigue-related stand-downs?

Fleets that lack this operational “audit trail” get marked as higher risk and pay the price.

From Reactive to Predictive: The New Insurance Playbook

Most fleets still manage safety reactively. Cameras catch fatigue after it happens. Telematics alert supervisors after harsh events occur. Fatigue policies exist, but are hard to enforce consistently.

The problem? Insurers see through that.

What’s needed now is a predictive approach that shows you’re preventing incidents before they happen. That’s where Readi comes in.

Readi: Your Insurance Ally in Fatigue Risk Mitigation

Readi is a predictive fatigue risk management platform used by fleets across North America and Latin America to proactively manage driver fatigue and improve shift decisions.

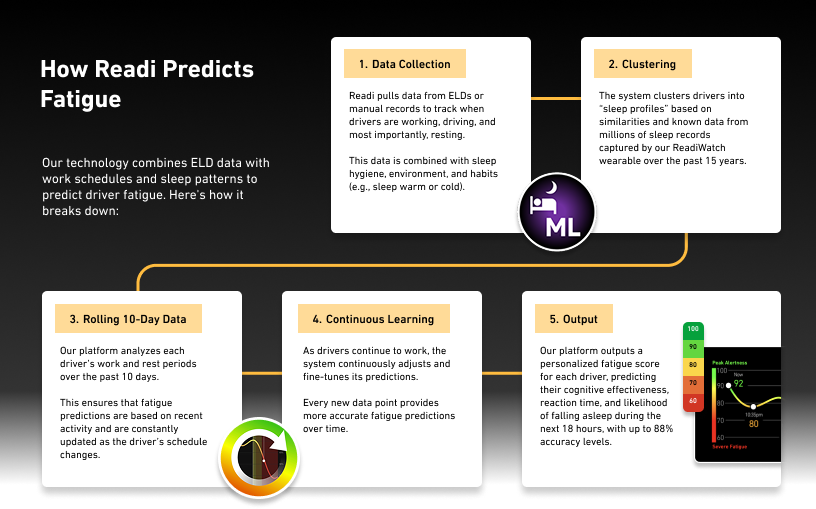

Here’s how it works:

-

Readi analyzes ELD data, schedules, and sleep opportunity estimates (no wearables required)

-

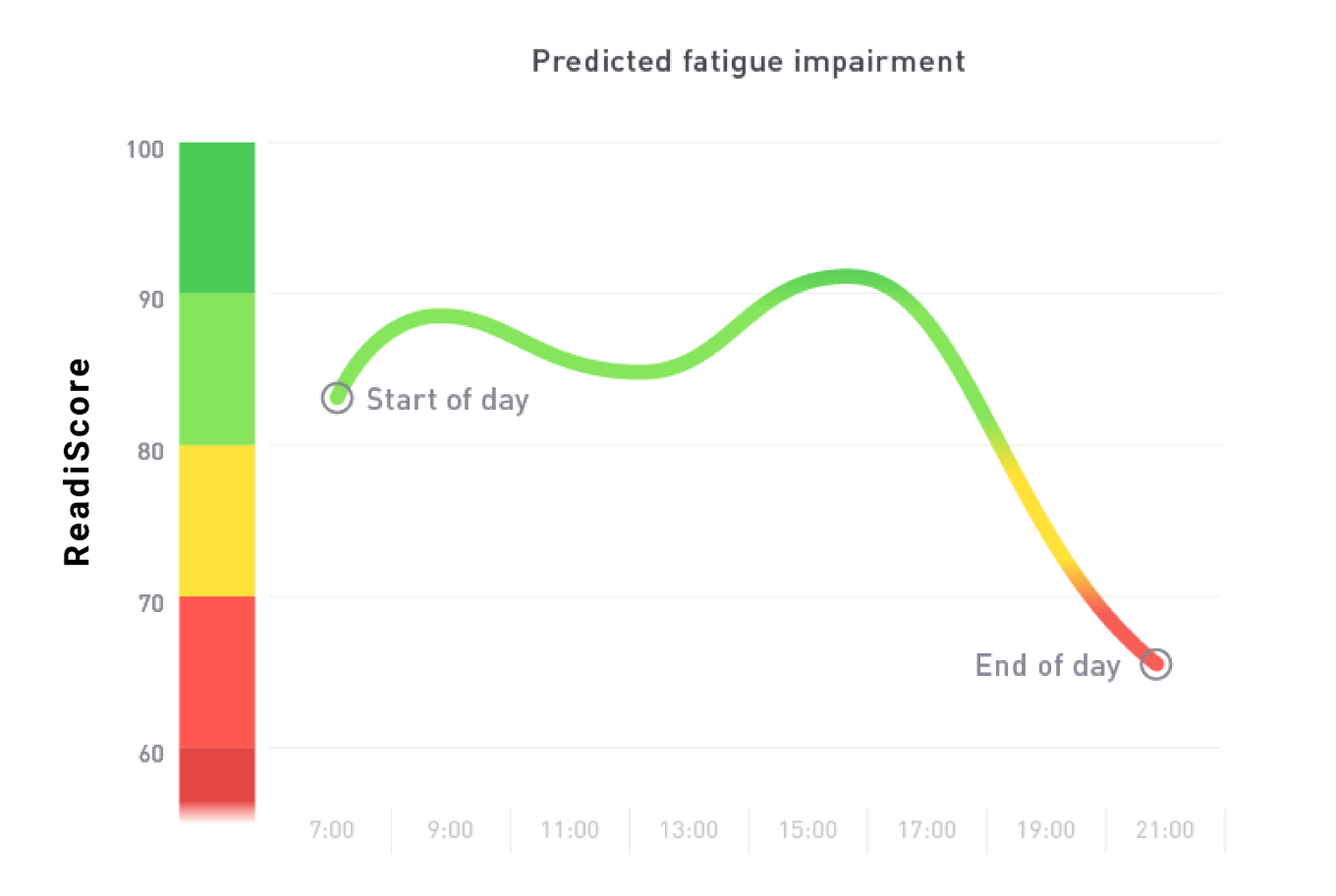

It delivers a personalized ReadiScore for each driver, showing predicted fatigue risk up to 18 hours in advance

-

Supervisors and dispatchers see who is at risk before the shift begins, and make adjustments, like shift swaps, break timing, or stand-downs

-

All actions are logged for reporting and documentation

“Insurance providers don’t want another camera system. They want proof that you’re doing something before an incident happens, and Readi gives you that proof.”

— Solange Messier, Fatigue Science

The Insurance Benefits of Using Readi

Readi is more than just a safety tool. It’s an asset during your next renewal discussion.

Here’s how:

✅ You Reduce Preventable Incidents

Fleets using Readi alongside in-cab cameras have seen up to 58% fewer fatigue-related alarms on night shifts. Fewer alarms mean fewer distractions, fewer false positives, and fewer true fatigue events making it to the road.

✅ You Create Documented Safety Protocols

Readi logs fatigue risk predictions and countermeasures. That means when an underwriter asks what you’re doing about fatigue, you can show real data, real decisions, and a repeatable process. It’s defensible, auditable safety management.

✅ You Demonstrate Leading Indicator Control

By acting on ReadiScores, you’re moving from lagging to leading indicators, the exact kind of risk posture insurers want. You’re not waiting for a crash; you’re making decisions that prevent it from ever happening.

✅ You Strengthen Your Claims Defense

If an incident does occur, Readi’s logs help demonstrate that your team followed a proactive fatigue risk protocol. That can significantly reduce legal exposure and support your defense in liability claims or litigation.

✅ You Improve Driver Safety and Retention

Readi helps supervisors protect at-risk drivers. That means fewer injuries, fewer stress-related absences, and better morale, which leads to improved retention and fewer unplanned absences (another insurance trigger).

Insurance Is a Game of Signals. Make Sure You’re Sending the Right Ones

At the end of the day, your insurance costs are shaped by how risky you look, not just what actually happens.

Fleets that fail to evolve from reactive to predictive tools will continue to pay more, get less coverage, and be squeezed by rising liability concerns. Fleets that show a proactive, data-driven posture, especially around high-impact areas like fatigue, will have leverage.

“You can’t control premiums directly. But you can control the signals you send to underwriters, and Readi changes that conversation completely.”

— Solange Messier, Fatigue Science

The Bottom Line

Fatigue is just one part of your insurance picture, but it’s a high-leverage one. It’s preventable, measurable, and increasingly scrutinized by carriers.

By integrating Readi, you give your team the ability to detect and mitigate fatigue risk before drivers get behind the wheel. Plus, you give your insurance broker something they can actually take to the market to fight for lower rates.

If you're preparing for renewal or facing premium increases, it's time to add Readi to your insurance risk playbook.

Prediction isn’t optional anymore. It’s protection.

Related Posts

-

Top AI Trends for Fleets in 2026The trucking industry is entering a new phase of digital maturity. What began as basic telematics and compliance automation is...

-

Fatigue, Fleet Safety, and the Nuclear Verdict Era: Why Predictive Risk Management Is No Longer OptionalThe trucking industry is under legal siege. As reported by the American Transportation Research Institute (ATRI), litigation...

-

How AI Is Powering Competitive Advantage in Fleet ManagementFleet managers are turning to artificial intelligence (AI) not just to streamline operations but to win. From real-time...